The Global Landscape of Cryptocurrency Regulations

In an ever-evolving digital age, cryptocurrencies have emerged as a transformative force in the financial world. As these digital assets gain popularity, governments across the globe are racing to establish regulatory frameworks to ensure their responsible use. Let’s delve into cryptocurrency regulations, examining how countries approach this groundbreaking financial phenomenon.

United States: Navigating the Regulatory Maze

Balancing Innovation and Compliance

The United States, often at the forefront of technological innovation, is grappling with balancing the promotion of financial technology (FinTech) advancements with the need for comprehensive regulation. Cryptocurrency in the U.S. operates within a complex web of federal and state regulations, making it crucial for businesses to navigate this intricate landscape.

Key Regulatory Bodies

The oversight and regulation of digital assets fall under the purview of the U.S. Securities and Exchange Commission (SEC). They categorize cryptocurrencies into three main groups: securities, commodities, and currencies, each subject to distinct regulations. This categorization aims to provide clarity for investors and entrepreneurs while mitigating risks associated with these assets.

United Kingdom: Embracing Innovation

Fostering a Thriving Crypto Ecosystem

In the United Kingdom, regulators have taken a proactive approach to cryptocurrency. The Financial Conduct Authority (FCA) oversees the crypto sector, striving to create a safe and conducive environment for innovation. By implementing know-your-customer (KYC) and anti-money laundering (AML) requirements, they aim to balance innovation and consumer protection.

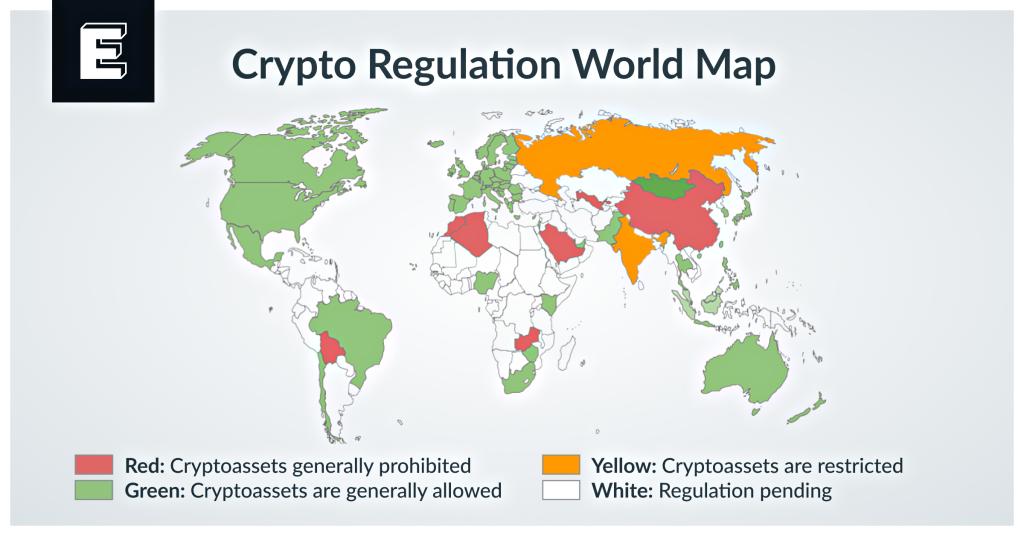

China: A Cautious Approach

Restricting Cryptocurrency Activities

China has taken a more cautious stance, often making headlines for its stringent regulations. The government’s actions include prohibiting initial coin offerings (ICOs) and enforcing stringent controls on cryptocurrency trading. Their primary concern revolves around financial stability and the prevention of capital flight, leading to a conservative approach.

Switzerland: The Crypto Valley

Encouraging Crypto Startups

Conversely, Switzerland has established itself as a worldwide center for cryptocurrency and blockchain advancements. Its clean and favorable regulatory environment has attracted numerous crypto startups and businesses. The Swiss Financial Market Supervisory Authority (FINMA) oversees the sector, focusing on investor protection and combating illicit activities.

Transition Words for Clarity

To ensure a smooth flow of information, it’s essential to incorporate transition words. Transition words like “however,” “furthermore,” and “consequently” help readers follow the narrative seamlessly.

In conclusion, cryptocurrency regulations worldwide are diverse, reflecting the unique approaches of different countries. The United States seeks to balance innovation with compliance, the United Kingdom fosters a thriving crypto ecosystem, China maintains caution, and Switzerland encourages crypto startups. As this digital revolution continues, staying informed about these global regulatory trends is crucial for anyone involved in cryptocurrency.

Remember, the cryptocurrency landscape is ever-changing, and staying updated with the latest developments in regulations is vital for investors, entrepreneurs, and enthusiasts alike.